Stock Information

-

$

Open$Prev Close$$ Change$% Change%VolumeShares Outstanding52 Week High$52 Week Low$High$Low$Bid$Ask$Bid SizeAsk SizeLast TradeUpdated AtData delayed 15 minutes unless otherwise indicated. Market data powered by QuoteMedia. -

$

Open$Prev Close$$ Change$% Change%VolumeShares Outstanding52 Week High$52 Week Low$High$Low$Bid$Ask$Bid SizeAsk SizeLast TradeUpdated AtData delayed 15 minutes unless otherwise indicated. Market data powered by QuoteMedia. -

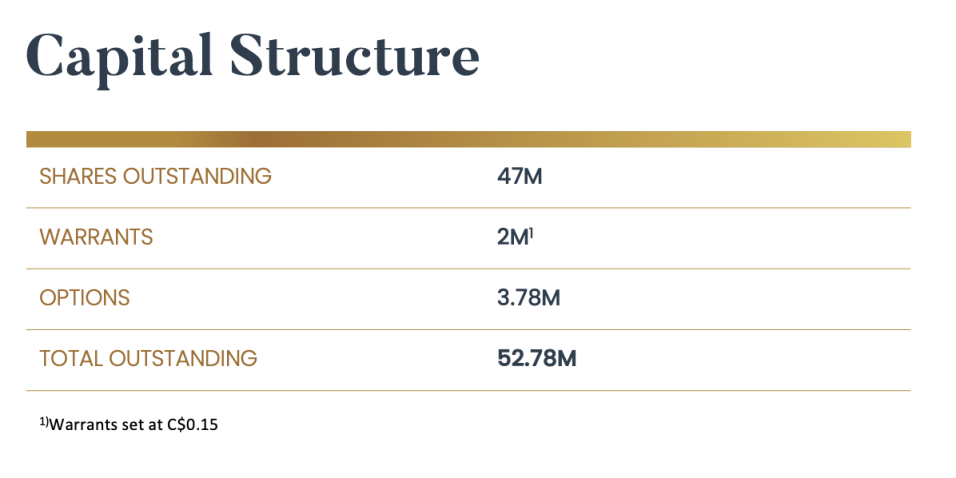

Capital Structure